Navigate Your Online Income Tax Return in Australia: Vital Resources and Tips

Browsing the online tax obligation return procedure in Australia needs a clear understanding of your commitments and the resources readily available to improve the experience. Important documents, such as your Tax Obligation File Number and earnings declarations, should be diligently prepared. Choosing an ideal online platform can dramatically affect the performance of your filing procedure.

Understanding Tax Commitments

People have to report their revenue accurately, which consists of earnings, rental earnings, and financial investment incomes, and pay tax obligations appropriately. Citizens need to recognize the distinction between non-taxable and taxable income to ensure conformity and maximize tax obligation results.

For businesses, tax obligation commitments include multiple facets, including the Goods and Provider Tax (GST), company tax obligation, and pay-roll tax. It is critical for services to register for an Australian Business Number (ABN) and, if relevant, GST registration. These responsibilities require careful record-keeping and timely entries of tax returns.

Additionally, taxpayers must recognize with readily available deductions and offsets that can alleviate their tax obligation burden. Inquiring from tax obligation professionals can give beneficial insights right into optimizing tax obligation positions while making certain compliance with the legislation. Overall, a thorough understanding of tax responsibilities is vital for efficient financial planning and to stay clear of penalties linked with non-compliance in Australia.

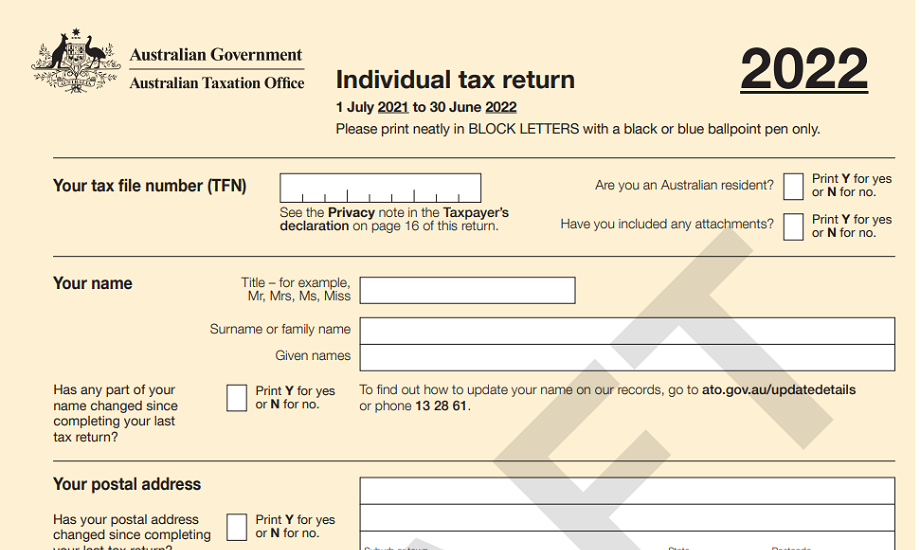

Important Records to Prepare

Furthermore, assemble any kind of pertinent financial institution declarations that reflect interest income, as well as dividend statements if you hold shares. If you have other incomes, such as rental buildings or freelance job, guarantee you have records of these earnings and any associated expenses.

Take into consideration any type of private wellness insurance declarations, as these can affect your tax obligation responsibilities. By collecting these crucial records in advancement, you will certainly improve your online tax return procedure, reduce mistakes, and take full advantage of possible refunds.

Picking the Right Online Platform

As you prepare to submit your online tax return in Australia, picking the best system is necessary to make certain accuracy and simplicity of use. A number of vital factors should direct your decision-making procedure. Initially, think about the system's interface. A straightforward, user-friendly layout can considerably boost your experience, making it easier to navigate complicated tax return.

Next, evaluate the platform's compatibility with your monetary circumstance. Some solutions provide especially to people with straightforward income tax return, while others provide comprehensive support for much more complex situations, such as self-employment or investment income. Look for systems that use real-time mistake monitoring and advice, aiding to minimize mistakes and ensuring compliance with Australian tax laws.

Another essential element to take into consideration is the degree of client support available. Trusted systems must offer access to aid by means of email, conversation, or phone, specifically during peak declaring periods. Additionally, study user testimonials and rankings to assess the general fulfillment and reliability of the system.

Tips for a Smooth Filing Refine

Submitting your online tax return can be a simple procedure if you follow a few key tips to make sure performance and accuracy. This includes your income statements, receipts for reductions, and any kind of various other relevant paperwork.

Next, make use of the pre-filling function supplied by Our site several online platforms. This can save time and decrease the possibility of errors by instantly inhabiting your return with information from previous years and data provided by your employer and banks.

In addition, ascertain all access for precision. online tax return in Australia. Blunders can lead to postponed reimbursements or concerns with the Australian Taxes Workplace (ATO) Make certain that your individual information, earnings figures, and deductions are appropriate

Filing early not just decreases stress however also permits for better preparation if you owe taxes. By adhering to these ideas, you can browse the on the internet tax return process efficiently and confidently.

Resources for Aid and Support

Navigating the intricacies of on the internet income tax return can often be difficult, but a read review range of sources for support and assistance are readily available to aid taxpayers. The Australian Taxation visit this page Workplace (ATO) is the key source of details, offering detailed guides on its web site, consisting of FAQs, training video clips, and live chat choices for real-time aid.

Additionally, the ATO's phone support line is readily available for those who choose straight interaction. online tax return in Australia. Tax experts, such as authorized tax obligation representatives, can also offer tailored guidance and guarantee conformity with existing tax regulations

Final Thought

Finally, properly browsing the on-line income tax return process in Australia requires a detailed understanding of tax obligation obligations, meticulous preparation of vital files, and cautious selection of a suitable online platform. Following sensible pointers can boost the declaring experience, while offered resources offer valuable aid. By coming close to the process with diligence and attention to information, taxpayers can make sure compliance and make best use of possible benefits, ultimately adding to an extra effective and successful income tax return outcome.

As you prepare to file your on the internet tax obligation return in Australia, choosing the right system is important to make certain accuracy and convenience of use.In verdict, efficiently browsing the online tax obligation return procedure in Australia needs a complete understanding of tax obligations, careful preparation of necessary documents, and cautious option of a suitable online system.

Comments on “The Full Overview to Sending an Online Tax Return in Australia in 2024”